Life Insurance process made easier with STATIM®

Transforming Insurance Business With STATIM®,

the next-gen Life Insurance Software Solution

The Insurance industry is on the cusp of digital disruption. However, legacy players are facing several challenges to survive in today’s competitive market. STATIM® is a cloud-powered Life Insurance solution that takes care of aspects like underwriting, policy administration, and claims processing. Built on a modular architecture, STATIM® will help acquire and retain policyholders, enable efficient risk management, and streamline the policy servicing process. Ultimately, it will facilitate insurers to overcome the obstacles of archaic regulations and legacy infrastructure.

Overcome The Business Complexities With Our Modularized Life Insurance Solution

-

Real-time sales and marketing analysis

-

Improved efficiency through automated workflows

-

Reducing operational cost and complexity

-

Eliminates redundancies

-

Customer-centric platform

-

High-performance analytics and improved business capabilities

Future-Proof Your Life Insurance Enterprise With STATIM®

STATIM® is an end-to-end, modularized insurance solution with multi-platform support that helps accelerate growth and streamline all channels of the insurance lifecycle.

An efficient and expert auto underwriting solution that automates underwriting decisions and facilitates risk triage into Standard, Refer/decline risk requirements. Product Configurator with inbuilt parameters for quick product and business rules configuration. It provides the ability to centralize, thereby enabling the reuse of calculations and business logic.

Our intuitive interface allows every authorized member of the organization to quickly view, schedule and execute everyday tasks while offering management control and improving accountability for decision-making throughout the organization. Provide robust performance criteria definitions, using the unique KPI engine for defining eligibility, calculations, and payouts.

Enables easy tracking and managing of entire insurance claims (Both Maturity & Death) processing with a flexible business rule and workflow configuration. CMS also provides triggers for generating notifications and comprehensive MIS reporting

Helps operational and executive management gain easy and timely access to high-quality, robust information required for decision-making to achieve the business goals.

Captures all insurance operational and general business transactions processed in real-time from all system modules, including up-to-date financial information like P&L, Trial Balance, balance sheet from multiple ledgers, accounts payable, accounts receivable, and General Ledger.

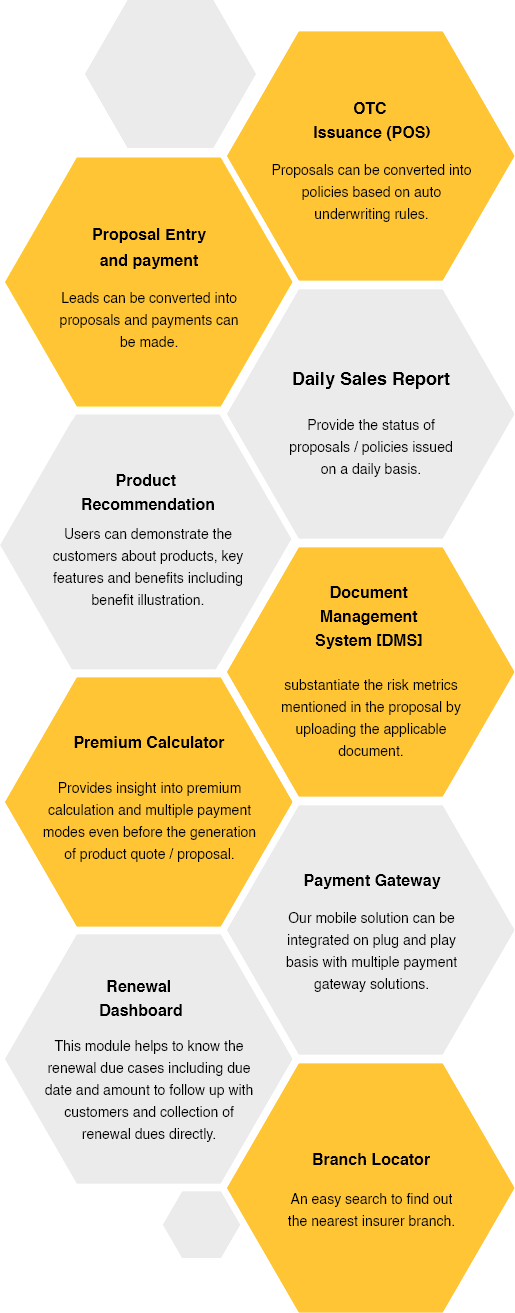

mSTATIM™ - Simplified, Optimized, and Modernized Insurance Process

Our mSTATIM™ Mobile application helps insurers modernize and transform for the future. It is a state-of-the-art mobility solution that enables users to self-service their leads, proposals, pending requirements, policies, update contact information, view policy status, renewal receipting, policy service requests, payout eligibility and much more. Here are the offerings in detail:

Enabling Insurance Companies To Adapt, In Order To Thrive The Transformations Of Futuristic Innovations

-

Multiple Channels and Hierarchy can be configured

-

Individual rating and pricing engine component

-

Comprehensive risk referencing solutions

-

360-degree integrated solution

-

Transparency across all processes

-

Fully automated workflow

-

Improve operational efficiency

-

Flexible to changing regulatory requirements

Want to Know the Inner Workings of Statim®?

Give Us a Shout Out

Tell us a little about yourself and we’ll be in touch right away

What Our Customers Say

Novac's Ziva team has worked extensively and alongside to help us overcome the issues that our business has faced. A digital lending solution with seamless inner workings has opened up various avenues in the financial business.

COO, EQUITAS

As a startup in the financial domain, my company was in need of a lending solution with multi-faceted features and modules. Novac’s Ziva became the perfect fit for my company with project transparency from inception till delivery.

CTO, PIRAMAL HOUSING FINANCE

Novac's Ziva team has worked extensively and alongside to help us overcome the issues that our business has faced. A digital lending solution with seamless inner workings has opened up various avenues in the financial business.

COO, EQUITAS

As a startup in the financial domain, my company was in need of a lending solution with multi-faceted features and modules. Novac’s Ziva became the perfect fit for my company with project transparency from inception till delivery.

CTO, PIRAMAL HOUSING FINANCE

Novac's Ziva team has worked extensively and alongside to help us overcome the issues that our business has faced. A digital lending solution with seamless inner workings has opened up various avenues in the financial business.

COO, EQUITAS

As a startup in the financial domain, my company was in need of a lending solution with multi-faceted features and modules. Novac’s Ziva became the perfect fit for my company with project transparency from inception till delivery.